News

News from our fields of activity

News and articles on all topics and developments that drive us and keep us busy.

Reminder: Visit AutoView® at Automechanika!

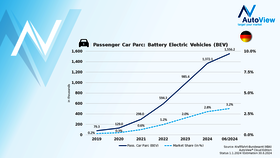

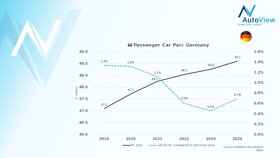

Quo Vadis electromobility?

Invitation Automechanika 2024

AutoView® glows with current trends and sparkles with new product potentials